Falling Behind on AI Automation? 5 Signs CFOs Can’t Afford to Ignore

Today’s CFOs are far more than just financial stewards. On any given day, they can play the role of growth architect, risk manager, digital champion and strategic visionary.

But despite the fact that 9 out of 10 CFOs are now responsible for business-critical decisions that impact the entire organization, many have still not moved beyond the siloed systems and manual processes of the past. In an era defined by volatility, the impact can be seismic: missed insights, delayed decisions, strained relationships and a less competitive, less resilient business.

Fortunately, CFOs have options — adopting a unified AI Automation Suite being a top contender. This blog highlights five signs that your Office of the CFO (OCFO) may be falling behind on the latest technological advancements, along with practical insight on how to close the gap and lead your company with clarity and confidence.

5 signs your finance team needs AI automation

1. Your tech stack is siloed … and so are your teams.

Growth is the goal, right? It is, but it doesn’t come without its share of complications. Decentralized investments and M&A activity, for example, can lead to a tangled web of ERP systems and point solutions. And while each tool might solve a specific business problem, they create silos of information that obstruct the OCFO’s ability to see the full picture.

Across various business functions and teams, this can also lead to:

- Duplicated efforts and document processing errors

- Inconsistent analytics and reporting

- Limited end-to-end visibility into key finance functions

Today’s CFOs need a 360-degree view of company performance. This is only possible with a unified platform that connects stakeholders, workflows and information across the full source-to-pay (S2P) and order-to-cash (O2C) cycles.

Esker’s AI Automation Suite for the Office of the CFO ensures that speed, precision, and transparency permeate every business process — empowering CFOs to carry out the organizational vision with laser-like focus and confidence. Compared to point solutions, CFOs using Esker can expect:

- Seamless cross-ERP integration vs. high costs, silos and complexities

- Standardized process and workflows vs. data inconsistencies and duplication

- Stronger security and compliance vs. risks and vulnerabilities

- Lower IT maintenance costs vs. high IT overhead

- Real-time visibility and analytics vs. limited data and insights

- Unified and intuitive UX vs. fragmented and inconsistent UX

- Streamlined and automated workflows vs. disconnected and inefficient workflows

- Scalability and future-proof growth vs. growth limitations

In terms of processes, Esker’s AI Automation Suite enables CFOs to reimagine the business as one interconnected system for strategic financial execution. This includes single-interface solutions that span:

S2P processes

- RFX management, e-auctions and supplier selection

- Supplier onboarding and data management

- Purchase request and approval workflows

- AP automation, invoice validation and payment control

- Supplier risk and compliance tracking

- Supplier inquiry and dispute management

O2C processes

- Customer order capture and workflow routing

- Credit approval and customer risk visibility

- Invoice delivery and e-invoicing compliance

- Collections prioritization and AI-driven dunning

- Dispute management and cash application

- Customer experience analytics across billing and service

2. You lack timely insights to make strategic decisions.

The OCFO can’t navigate uncertain terrain if it’s only reacting to what’s already happened. Shockingly, however, 92% of CFOs say forecasting accurately is a challenge, with nearly half (46%) citing it as a “significant challenge.”

Arguably the biggest factors contributing to this lack of accurate insight are legacy systems and manual processes, which undoubtedly constrain CFOs in their ability to:

- Perform accurate budgeting and forecasting

- Analyze investments and capital allocations

- Benchmark performance against peers

- Manage liquidity and conduct scenario analysis

- Navigate tax compliance and evolving M&A activities

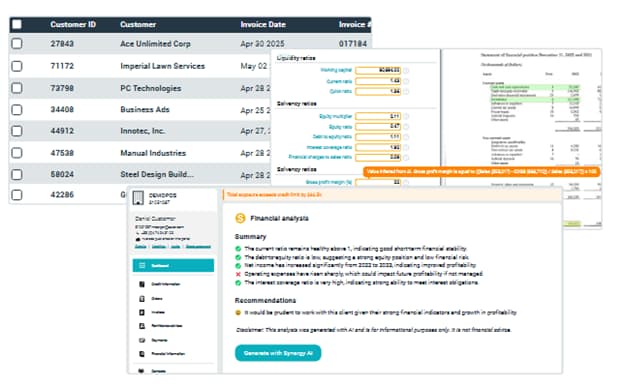

Running an agile, competitive business in 2025 demands accurate and integrated data for guiding decision-making. Once again, Esker’s AI Automation Suite simplifies the struggle by equipping the OCFO and all the teams within its company-wide scope with custom dashboards that provide:

- Improved access and collaboration around financial data

- Real-time data tracking for instant visibility into all customer and supplier actions and performance

- Predictive forecasting and individual/team performance monitoring

As Baldwin Supply Co.’s CFO noted in a recent Esker customer case study:

“It gives us visibility from a billing and forecasting standpoint that we just didn’t have previously and helps us make decisions faster.”

3. Cashflow and working capital disruptions are hitting harder.

As CFO, you can’t earn the moniker of “growth architect” by only achieving generic payoffs like cost savings or efficiency gains. It’s why, in 2025, CFOs ranked optimizing cashflow, liquidity and working capital as their No. 1 priority. And for good reason: Market uncertainty, interest rate shifts and supply chain turbulence have all made it more difficult to maintain healthy financial fundamentals.

Fortunately, autonomous finance solutions like Esker’s are built for addressing these scenarios — enabling the entire business to operate as an efficient, well-oiled machine so cashflow management and profitability are ensured.

In a process like receivables, for example, AR teams can enable longer-term planning, growth initiatives, and resilience during market swings thanks to Agentic AI and other AI-driven capabilities that enable users to easily:

- Predict incoming payments

- Prioritize at-risk accounts for collections

- Accelerate invoice approvals and dispute resolution

- Model cashflow scenarios and payment timing

- Streamline financial data analysis within credit management

4. Critical relationships with customers, suppliers and employees are strained.

Running a successful business is more just good numbers — it’s built on relationships. And when these critical relationships are strained due to error-prone, time-wasting and tedious business processes, it’s your reputation and employee morale that take the hit.

Unhappy customers lead to churn and budget strain from increased support costs. Frustrated suppliers may delay shipments, raise prices or cut ties altogether. And disengaged employees — burdened by repetitive, manual work — are more likely to leave or underperform.

Esker’s AI Automation Suite can reverse the tide — enabling more proactive communication, faster turnaround times and more fulfilling roles for your people.

A good example of this is the customer inquiry management process. Tools such as Natural Language Understanding (NLU) and Generative AI (GenAI) are used within customer inquiry management to analyze the content of order data, determine sentiment, and suggest relevant responses to non-order inquiries, including product questions, price, and availability requests, and more — helping B2B Customer Service staff be more proactive, purposeful and fulfilled. In turn, customers get faster, meaningful responses, helping them feel more valued and satisfied.

5. New risks and requirements are becoming harder to manage.

CFOs now find themselves squarely at the center of risk management — a landscape that’s expanding daily. Among the many issues CFOs are expected to oversee are:

- Strengthening cybersecurity infrastructure

- Meeting sustainability and ESG reporting standards

- Navigating economic disruptions (inflation, supply chain breakdowns)

- Complying with shifting legal and regulatory requirements

- Planning for strategic M&A and tech innovation risks

Without automation and real-time intelligence, these expectations quickly become unmanageable. AI-driven platforms help centralize risk tracking, enhance audit readiness and create repeatable workflows that scale.

One note-worthy case of this in action is within Procurement departments — specifically, the purchase requisition process. Esker’s AI Automation Suite helps protect the organization from potential overstocking, shortages, financial loss and reputational damage by leveraging machine-learning algorithms to detect anomalies when unusual quantities are identified for specific items and suppliers.

Why AI automation is a game-changer for the Office of the CFO

Today’s OCFO faces a choice: Continue patching together outdated tools and systems, or step confidently into the future with a unified, end-to-end automation suite.

For those seeking intelligent, purpose-built solutions capable of connecting the entire business, Esker’s AI Automation Suite for the Office of the CFO might just be the perfect choice, offering:

- End-to-end visibility: Real-time insight across AP, AR, Procurement, and Finance

- Global compliance: Built-in standards to meet international regulations

- ERP integration: Connects easily to SAP, Oracle, Microsoft, and more

- Scalability: Flexible to support growth and change

- Human empowerment: Automates low-value tasks to elevate strategic work

Learn more about Esker’s CFO-friendly automation solutions by visiting our Source-to-Pay and Accounts Receivable solution pages.

Ready to get started with Esker? Request a demo to see how our solutions can help your Office of the CFO.