AI in Accounts Receivable

Delivering greater speed & strategy to the entire invoice-to-cash cycle

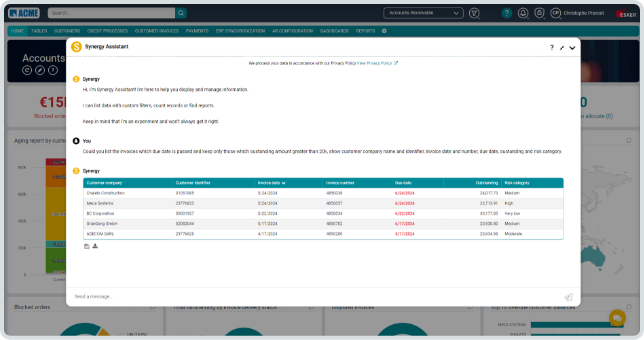

Esker Synergy AI

A discrete, digital assistant

supporting your AR team

Esker Synergy AI is a set of AI capabilities (deep learning, machine learning, NLP, LLMs, Generative AI, etc.) and other intelligence tools (RPA, OCR, etc.) that power Esker’s AR automation software. Esker Synergy actively assists your AR team by streamlining daily activities and equipping AR managers with predictable insights. Our Accounts Receivable automation solution works by providing four specific capabilities:

Payment predictions

Esker Synergy uses predictive analytics to forecast when payments will likely arrive based on previous invoices, payments history and other customer data — improving efficiency with collections automation and visibility over incoming cash and AR performance.

Recommendations

Ever wish you knew what the optimal action was to take in any scenario? Now you can with Esker Synergy! Thanks to prescriptive analytics, you and your team can facilitate better decision-making and accelerate the entire invoice-to-cash cycle.

Data extraction

Esker Synergy automatically captures data from all AR documents and uses it to carry out critical actions (e.g., routing the document, matching a payment to an invoice, creating a claim, etc.). This removes the burden off the AR team and optimizes your invoice-to-cash automation efficiency.

Content analysis

Leveraging GenAI, Esker Synergy speeds up the processing of customer messages by suggesting responses and summarizing lengthy conversation threads. AR teams also benefit from chatbot assistance, enabling them to quickly search for data, generate reports and create graphs.

Generative AI

Boost your team’s

efficiency with GenAI

GenAI offers numerous benefits for accounts receivable managers, specialists, and teams by enhancing their efficiency, accuracy and overall performance. Here are some of the key advantages:

- Process customer messages faster with suggested responses generated by Esker Synergy AI

- Benefit from summaries of lengthy and complex email exchanges

- Easily find the information you need with Esker's chatbot

- Request and receive custom reports and graphs tailored to your needs

- Prompt Esker Synergy AI to (re)prioritize credit reviews dynamically

What our customers say...

“I absolutely love risk level prioritization on the system, it helped us drive our decisions every day and empowered the team members to work flexibly and autonomously."

“Esker has significantly reduced processing time for large remittances with 800+ line items from 2+ hours to mere minutes."

Payment predictions

Improve your collections efficiency with laser-like focus

Using machine learning that utilizes previous invoices, payments and other customer data, Esker Synergy can make payment predictions on each open invoice according to its status and customer payment behavior. Over time, these predictions determine a risk level for each customer by comparing their current and past payment behavior. This gives you predictable insights to proactively anticipate and prioritize collection efforts.

How is this featured in the solution?

The “projected collections activities” report predicts the collection effort needed over the next 7 days by combining payment predictions with data like promises-to-pay, logged calls and customer status. This prediction helps the AR manager understand the workload and adjust the strategy or allocate resources accordingly to meet collection goals.

Collections forecast report provides an aggregated view of expected payments within the next 30-90 days. These are based on the payment predictions and combined with promises-to-pay or payments scheduled on the customer portal. This report provides greater visibility on incoming cash so AR managers can make better forecasts and adjust strategies accordingly.

Prescriptive analytics

Guide your decision-making with smart suggestions

Esker Synergy AI facilitates decision-making at each step of the invoice-to-cash process by providing suggestions to the user. Not only does this improve overall AR performance, it makes life easier for the AR team by suggesting:

New credit limit or risk category

Esker Synergy makes recommendations to the credit analyst during a credit review to assign the right credit limit or risk category to the customer based on different criteria (e.g., scoring data, payment behavior, sales history, etc.).

Smart allocations (when multiple combos are possible)

When auto-matching can't be done, Esker Synergy provides suggestions for allocation to help the user find the right match between all possibilities and display the most relevant/likely allocation first.

Quick actions from customer messages

In the context of a customer message, NLP is used to recognize keywords and recommend actions to the user to help them process the messages more efficiently. Typically, quick user actions are suggested to meet the most common customer requests such as sending an invoice, updating a contact or logging a promise-to-pay.

Suggested responses & conversation summaries

LLMs enable the team to use suggested customer responses and summaries of lengthy conversations to gain time and efficiency in processing customer messages, especially the most complex ones.

Data extraction

Take paperwork & data entry out of your AR equation

As an expert in data extraction with several long-term developments and patents, Esker has the technological foundation to accurately capture documents like remittance advices or claims from emails and route them automatically to the right process and extract data from those documents to use it to automate the payment allocation or create a new claim to approve. And, in the case of user correction, Esker Synergy auto-learns to increase the accuracy the next time.

Esker's high recognition rate delivers immediate value to our customers:

+95%

Remittance processing time accelerated by 95% with Esker Synergy

How Esker Synergy empowers every AR stakeholder

One of the biggest benefits of Esker Synergy is its expansive reach — although all AR stakeholders have their own unique pains and processes, they all benefit from the AI-powered capabilities.

Credit analysts

- Collect, combine and weigh all the internal and external data required to assess customer’ credit risk and credit application status

- Suggest a risk category to assign to a customer according to their situation and credit rules/policy

- Suggest credit limit to assign to a customer according to their situation and credit rules/policy

Cash application & deductions specialists

- Route inbound remittances and claims to the solution

- Split batches of remittances or lockbox files

- Extract data from supporting documentation

- Find the right matching to auto-allocate a payment among multiple open items combinations

- Recommend allocation suggestions when auto-allocation is not possible

Collections specialists

- Provide payment predictions (per invoice and reports) and customer-estimated risk level

- Prioritize collection calls by risk level (critical/high/normal)

- Suggest deferring a call when payment is expected to arrive within the next 3 days

- Suggest quick actions and replies to customer messages in different languages

- Provide summary of lengthy conversations

AR manager

- Provide collections forecast at 30/60 days or more

- Predict collection effort based on collection strategy, customer and invoice data and payment predictions

- Provide predictable insights on the customer’s portfolio (expected payments and risk level)

- Create prompts to prioritize credit reviews more intelligently for the Credit team

- Help collect specific data and create reports or graphs

Positive-sum growth

Everyone wins with Esker Synergy!

Your process

The entire invoice-to-cash process benefits, resulting in greater efficiency in cash collection and DSO reduction.

Your team

Our invoice-to-cash automation software enhances the overall user experience thanks to highly intelligent and easily utilized automation, analytics and suggestions.

Your customers

The CX is improved thanks to better knowledge of the customer, better business decisions (e.g., credit limit) and faster replies thanks to NLP.