Mandatory e-invoicing for all B2B transactions

The French government announced in 2019 that e-invoicing would become mandatory for all domestic B2B transactions. This regulation is part of the government’s effort to tackle tax fraud by seamlessly transmitting all transaction data to its tax authority.

Invoices must be exchanged exclusively through a certified platform (PA, formerly PDP)* approved by the French Tax Authority. Companies will no longer be permitted to send invoices directly to their customers; instead, all invoices must be transmitted via an authorized third-party platform. The mandate will take effect starting September 1, 2026, with implementation phased according to company size. It is essential for all companies to understand these requirements and take the necessary steps to prepare for compliance.

The French Finance Law has four main objectives:

- Boost competitiveness

- Combat VAT fraud

- Increase business efficiency

- Simplify VAT returns

*PA: Plateforme Agréée and PDP: Plateforme de Dématérialisation Partenaire, as referred to by the French Tax Authority

Implementation schedule

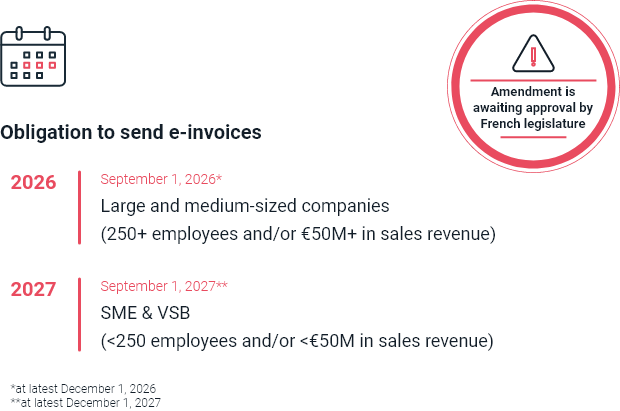

The date on which B2B e-invoicing in France will go into effect was postponed several times between 2020 and 2023. On December 29, 2023, Article 91 of the Finance Law 2024, 2023-1322 validated the following timeline. These are the official dates for mandatory e-invoicing for B2B transactions in France:

- September 1, 2026:

- Obligation to receive e-invoices for companies of all sizes

- Obligation to send e-invoices and e-reporting for large and medium-sized companies

- September 1, 2027:

- Obligation to send e-invoices and e-reporting for SMEs and VSB

- Obligation to send e-invoices and e-reporting for SMEs and VSB

E-invoicing & e-reporting

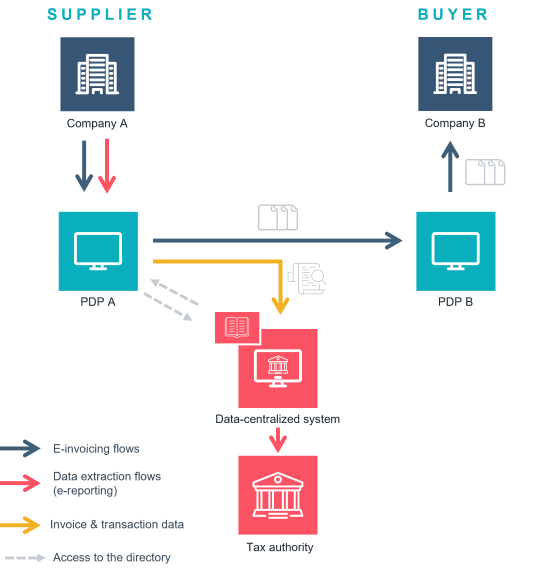

There are two components to the reform: e-invoicing and e-reporting. As mentioned above, e-invoices and e-reporting data must be submitted directly to the tax authority through a third-party solution, which is a certified platform approved by the French Tax Authority. France’s General Directorate of Public Finance (DGFiP) refers to this approach as the “Y” model, which allows registered private platforms to transmit e-invoices to recipients at the same time that the invoice data is transmitted to the French tax authority.

The DGFiP selected this model because it offers more flexibility by allowing companies to choose the e-invoicing technology provider of their choice while also conforming to the new government regulations.

E-invoicing

E-invoicing applies to domestic B2B transactions between companies subject to VAT. Invoices must be issued in a structured or hybrid format (structured + PDF). Platforms must be able to receive invoices in three mandatory formats: UBL, CII (structured formats) and Factur-X (hybrid format). The receipt of invoices in simple PDF format will no longer be accepted.

E-reporting

E-Invoicing will not be mandatory for B2C and cross-border invoices. E-reporting is the obligation to transmit invoicing and payment data for transactions that are not subject to domestic B2B e-invoicing requirements. It applies to international B2B transactions, B2C transactions, intra-community acquisitions, services provided outside the EU and receipts where VAT is due. E-reporting obligations will follow the same calendar as e-invoicing.

Preparing your company for B2B e-invoicing

There's a lot to navigate when it comes to ensuring compliance. Beyond understanding the different e-invoicing regulations, you want to make sure you avoid financial penalties. At €15 per invoice and €250 per non-compliant transmission, the fines can quickly accumulate and impact your bottom line.

Don’t get caught playing catch-up. Here are some helpful tips you can already get started on to ensure that your company is ready for September 1, 2026, and beyond!

Anticipate the impact on your IT systems

Collect all mandatory information necessary for all tax authority exchanges (domestic B2B e-invoicing, international B2B and B2C e-reporting). You must also select your platform for e-invoice transmission and reception.

Optimize your current invoicing exchanges

Choose one solution for all your current and future needs, including: domestic B2B exchanges, international B2B and B2C exchanges and sending invoices worldwide (in both paper and email or even in e-invoicing format).

Avoid bottlenecks

Everyone is up against the same deadlines and certified private providers will soon be inundated with requests and workloads. Don’t be at the mercy of your provider’s availability! Make sure you are up to speed on the latest reform updates and existing solutions. Anticipate solution implementation and user training, and carefully coordinate your project internally.

Maintain good relationships

Closely monitor and maintain relationships with the tax authorities, your customers (who expect you to be in compliance in order to pay you), and your suppliers (who will know that you have received the invoice and expect you to pay on time).

How to ensure full compliance with France’s 2026 e-invoicing mandate

Benefits of using a certified platform for e-invoicing

A certified platform (PA) transforms, validates and sends invoices to the French tax authority, as well as reports the invoicing data required for e-reporting to the French tax authority. Certified platforms are the only ones that can exchange invoices directly.

Acting as an intermediary between companies and the tax authorities, certified platforms play a key role in the digitization of invoicing and accounting processes, including:

- Facilitating the transition to the e-invoicing reform

- Ensuring compliance

- Supporting businesses in the digitization of invoice

processing, both sending and receiving - Transmitting invoices in one of the mandatory structured electronic formats

- Performing invoice controls, extracting required data, handling e-reporting,

retrieving the status of transmissions, etc.

The digitization of invoicing processes has significant benefits for businesses and governments. It reduces paperwork, eliminates errors and delays, and saves time and resources. It also improves compliance with tax regulations and enhances transparency and accountability. The role of certified platforms is critical in achieving this goal, as they provide a bridge between businesses and the tax authority.

Why choose Esker for e-invoicing in France

- Key player in the French invoicing market and present internationally through 15 subsidiaries

- Global leader in automated source-to-pay and order-to-cash solutions, helping companies digitize their invoice processing, both inbound and outbound

- 40 years of experience with 20+ years focused on cloud solutions

- Global compliance in over 60 countries

- Platform ISO 27001 certification

- Actively participates in consultation workshops led by the DGFiP (French Tax Authority) to remain updated on industry evolutions and provide up-to-date information to its customers

- Active member of the Forum National de la Facture Electronique et des Marchés Publics Electroniques (FNFE-MPE), which promotes the use of e-invoicing in France and helps Esker keep up with regulatory changes in invoicing

- Solutions connected to different government platforms (Chorus Pro, SDI in Italy, FACe in Spain, etc,) and interoperability networks including PEPPOL

- Officially registered by France’s DGFiP as a certified platform for e-invoicing. Esker's application was one of the first to be considered complete and valid by the DGFiP.