Title

What is Invoice-to-Cash: The Key to Your Company’s Financial Vitality

When a business sells goods or services on credit, it generates an invoice. Until it’s paid by the customer, this invoice is considered accounts receivable (AR) — money the business expects to collect in the future.

The central role of AR departments has always been to convert these theoretical IOUs into actual cashflow for their company. However, the role of AR has become increasingly vital in recent years.

In the face of ongoing challenges like supply-chain disruptions, fluctuating interest rates and economic uncertainty, the Office of the CFO is more focused than ever on pursuing resilient business practices that can ensure financial stability and support long-term growth. Thus, AR teams have been propelled into a more strategic position within the enterprise.

This transformational shift has prompted many AR departments to look inward and reevaluate every step of AR, particularly the invoice-to-cash process, which describes the path from invoice to collections.

Here, we’ll examine the ins and outs of the invoice-to-cash process, its impact on cashflow, competitiveness and customer experience, and what solutions and technologies are most effective in optimizing these efforts.

What is invoice-to-cash?

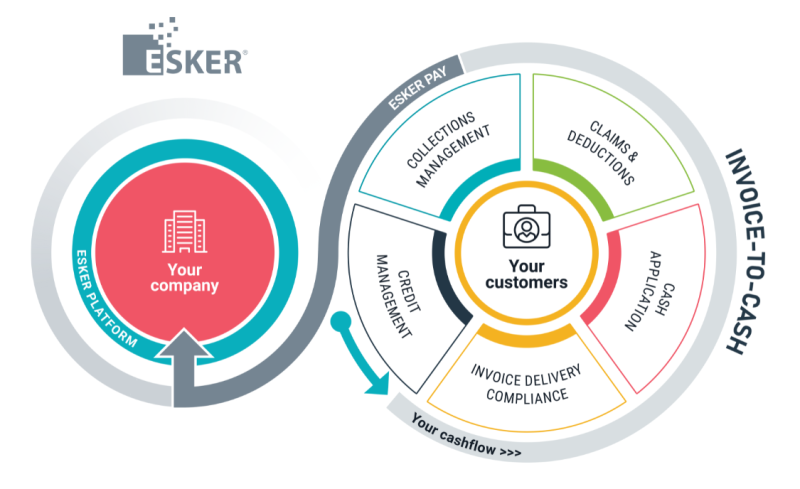

The invoice-to-cash process encompasses all the steps that take place between the time an invoice is delivered until the time a payment is received. Thinking of the AR department in terms of infrastructure, the invoice-to-cash process is the bridge that connects services rendered and revenue realized. The stronger, more seamless the bridge is, the healthier your cashflow.

The six primary components of the invoice-to-cash process include:

- Credit management.

Credit management involves evaluating customers’ creditworthiness, setting appropriate credit limits and monitoring payment behaviors. Credit management is at the core of a company’s financial health, and when operating effectively, improves company liquidity and DSO performance. Unfortunately, manual processes can make tasks like determining risk levels and credit terms far slower (and riskier) than they should be. - Invoice delivery.

Invoice delivery is exactly what it sounds like: The process of notifying a customer that payment is due by means of sending an invoice. Not only can invoice delivery performance impact cashflow, it’s also rife with other complications (e.g., complying with global e-invoicing regulations, adhering to customer delivery preferences) that make life harder for AR departments. - Payment processing.

Payment is simply the series of steps that enable the safe and secure transfer of funds from a customer to a company. The authorization, verification and settlement of financial transactions are not only crucial elements of customer experience, they also have huge ramifications on cashflow management and forecasting. - Cash application.

Before a company’s cash can be used and distributed by Accounting, payments must first be matched to the correct invoices and customer accounts. This is the process of cash application. Once again, manual processes are big disruptors to this crucial process — impacting the ability to control cashflow, keep costs under control and understand where your company stands financially. - Deductions management.

A deduction occurs when a customer doesn’t pay or disputes the full invoice amount. Managing this all-important process is key to optimizing cashflow and maintaining healthy financial relationships with customers. Not only does it require valuable time to investigate and resolve each deduction, the process can also be costly in terms of lost revenue for the company. - Collections management.

Collectively, the strategies and procedures that AR departments have in place to oversee the collection of unpaid bills from customers is referred to as collections management. An inefficient, poorly run collections management process is indicative of a company with insufficient cashflow and, potentially, an inability to meet its basic financial goals.

Why is Invoice-to-Cash so important?

It is not hyperbole: A company’s survival depends on having a clear, accurate understanding of money owed and money received. And against an external backdrop of pessimism and uncertainty, effectively managing the invoice-to-cash process enables companies to be nimble and efficient in how they use cash no matter the circumstance — enhancing liquidity and strengthening their financial foundation.

However, many AR departments have been slow to modernize the invoice-to-cash process. According to one recent study, despite 8 out of 10 businesses seeing AR as “more crucial” to company success in recent months, less than half of them (44%) believe their AR teams have the skills, tools and resources needed to contend in the current landscape.

Where does AI-driven automation fit in?

Automation solutions offer hope to today’s AR departments by filling in manual gaps in the invoice-to-cash process that prevent timely cash collection and revenue recognition. What’s more, best-in-class solutions are powered by the latest AI technologies, which act as a discrete, digital assistant that empower your existing team members with everything from data extraction and task prioritization to predictions and recommendations.

Benefits for your team

- Fewer manual tasks (e.g., entering key data points into spreadsheets or printing), which frees up AR team for more fulfilling, higher-value work

- Simplified payment-reconciliation process

- Tracks different payment types and monitors all aspects of collections, such as establishing early payment incentives

- 100% visibility over the customer journey

- Accelerated invoice delivery and reduced risk of billing errors

- Real-time reporting on invoice and payment status

- Improved customer experience thanks to greater accuracy and timeliness in billing, payment reconciliation and credit decisions

Benefits for the Office of the CFO

- Faster payments and improved cashflow and revenue recognition

- Decreased DSO and write-offs

- Lower operational costs

- Ensured global e-invoicing compliance

- Advanced reporting and analytics into company’s financial health

- Improved attraction and retention of talent by offering meaningful work and creating opportunities for professional growth

- Improved inter-departmental communications via internal conversations and approval workflows

- Increased resilience for the entire business ecosystem

While external factors impacting accounts receivable are largely uncontrollable, AI-driven automation solutions address the manual gaps within the invoice-to-cash cycle that can be controlled. This is done by automating the root causes of late payments, subpar cashflow, disgruntled employees and dissatisfied customers.

Creating this seamless and well-constructed “bridge” from invoicing to cash collections ensures that the accounts receivable department is always holding up its end of the bargain in supporting the overall financial health and growth of the company.

Subscribe to new posts