Elevate Your Accounts Receivable Strategy & Performance

Esker’s Accounts Receivable automation software suite uses machine learning, GenAI and other digital tools to support the Office of the CFO — driving lower DSO, enhancing cash forecasting and improving working capital.

Rethink receivables

management

Esker’s Accounts Receivable automation software suite is ideal for AR leaders wanting to accelerate cash collection and revenue recognition. Powered by Esker Synergy AI, it can be easily scaled to optimize and connect each step of the invoice-to-cash (I2C) process — improving overall efficiency, visibility and collaboration. The result is not only reduced DSO, but an enhanced experience for every user.

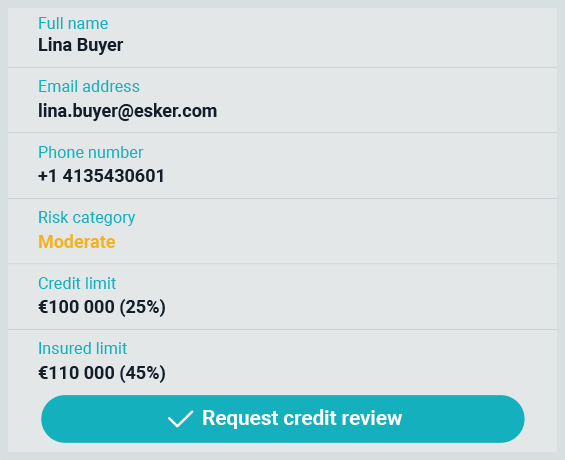

Credit Management

Secure your revenue through an optimized credit approval and risk monitoring process designed for ultimate security and simplicity.

Invoice Delivery

Automate the delivery of invoices according to customer preferences and in 100% compliance with regulations in over 60 countries.

Payment

Get paid faster thanks to online payment options across the globe and other payment facilities from a secured customer portal.

Cash Application

Allocate your customers’ incoming payments faster and more accurately with AI-powered remittance management and auto-matching.

Claims & Deductions

Resolve customer disputes quicker and keep short payments under control with AI data capture and electronic workflow capabilities.

Collections Management

Collect cash from your customers easily and more efficiently by prioritizing tasks based on AI-driven predictions and risk analysis.

Raising the bar on AR outcomes

From DSO reduction and operational savings to higher talent retention and faster invoice processing speeds, Esker’s Accounts Receivable solution suite is used by companies all over the world to elevate their AR outcomes.

Artificial intelligence

Enhance every action & interaction impacting cash collection

At Esker, we think the best AI is that which benefits everyone. That’s why Esker Synergy acts behind the scenes to empower every user while improving the end-to-end CX. Whether it’s facilitating decisions via intelligent suggestions, quickly routing and extracting data from all your AR documents, or providing you with an accurate forecast of incoming cash, Esker Synergy enhances the automation of your I2C process so you can achieve your end goal — faster cash collection.

Learn how AI optimizes the I2C process

Analyst accolades

See what the experts say

As a global cloud offering designed to optimize the invoice-to-cash process, Esker’s Accounts Receivable software suite has been recognized by multiple leading analyst firms over the years. Most recently, these include:

Esker named a Leader in the 2024 Gartner® Magic Quadrant™ for Invoice-to-Cash Applications and a Strong Performer in 2023 Gartner® ‘Voice of the Customer’: Integrated Invoice-to-Cash Applications

Esker listed as a Digital World Class® Provider in Customer-to-Cash Receivables Creation Software Hackett Excelleration Matrix™️

Esker listed in the Forrester Accounts Receivable Invoice Automation Landscape, Q1 2023

Make collections a truly

collaborative team effort

Getting paid in a timely manner requires a collective effort and the right technology in place to minimize tensions between people and departments. Regardless of your organization's configuration, Esker's solutions natively integrate with each other and offer collaborative tools that facilitate the interactions between team members within the I2C process and outside the AR department, as well as improving the visibility into customers’ receivables situation:

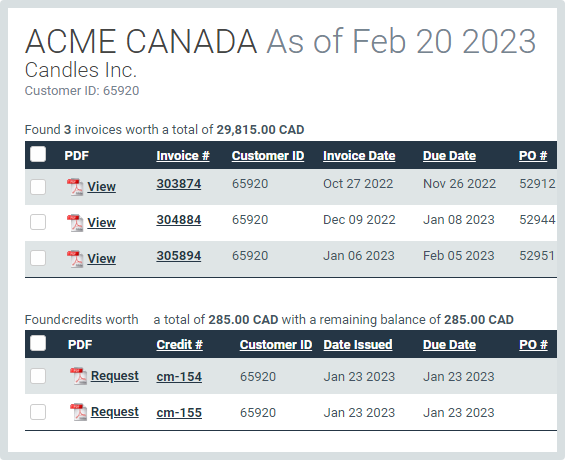

Centralized information & real-time data

Data is instantaneously available in the AR automation software suite (promise-to-pay, online payment, allocated payment, invoice delivery status, etc.).

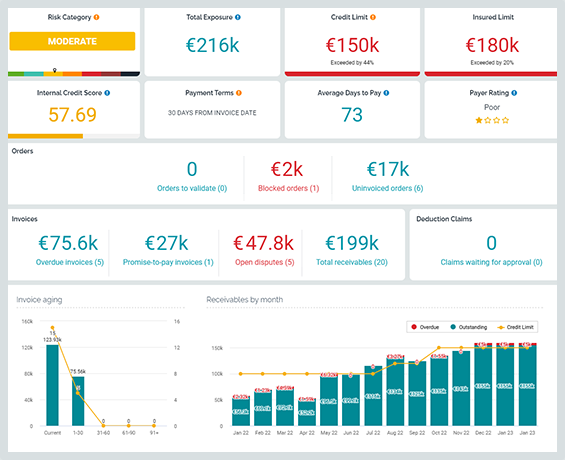

Customer Management

A 360-degree view on customers situation:

- Credit KPIs: Credit limit, risk exposure, risk category, etc.

- Business situation: Blocked & undelivered orders, invoices, pending claims, etc.

- Documents: Purchase orders, invoices, remittances, credit applications, contracts, etc.

Unlimited user access

All solutions are based on unlimited user access so anyone involved in the I2C process can access data anytime and get the visibility they need.

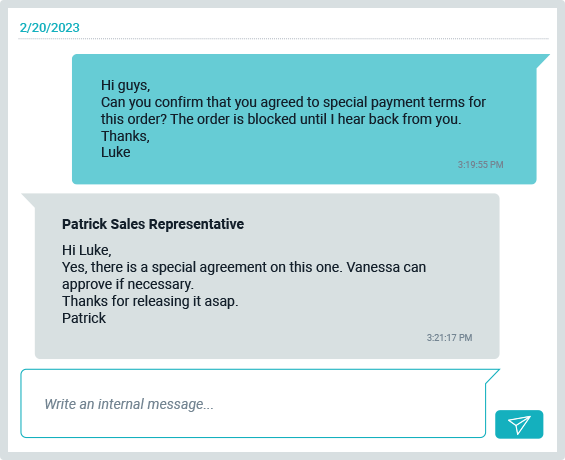

Internal conversations

Start a conversation with one or several coworkers from any process (credit review, allocation form, claim approval, etc.) to clarify a situation.

External conversations

Interact quickly with the customer to clarify an allocation or request a claim, supporting document or payment.

Task & dispute management

Create and assign tasks from disputed invoices to accelerate the dispute resolution process.

Cross-solutions business scenario

Easily address the most common business scenario to accelerate resolution (creating a claim from a short payment, requesting a collection call to release a block order, etc.).

Automated approval workflows

Create workflow rules to secure your decisions and automate the approval process when necessary (credit reviews, deductions validation, etc), as per your credit policy.

Esker Connectivity Suite

Integrates with any ERP or business application.

Connections to customers & AP portals

Esker supports 100+ connections with the most common AP portals (Coupa, Ariba, etc.) as well as customer portals to post invoices and retrieve AR information.

Customer portal

Esker’s AR solution suite is equipped with a customer and payment portal to facilitate customer relationships. Your customers can retrieve their invoices, and account statements with full autonomy and even pay online in 40+ countries worldwide.

Facilitating collaboration between Sales and Finance teams is crucial. That’s why Esker has equipped our AR solution suite with tools to make it much easier:

Mobile app

Esker AnywhereTM allows salespeople to request a credit check or review their customer situation at a glance anytime, anywhere so that they can make the right decision for the business.

API integration with Salesforce

By sharing collection notes instantaneously with the sales team’s main tool, you ensure your team is up-to-date with the customers’ receivables situations and the latest collections activity and notes, resulting in better business decisions and customer relationships.

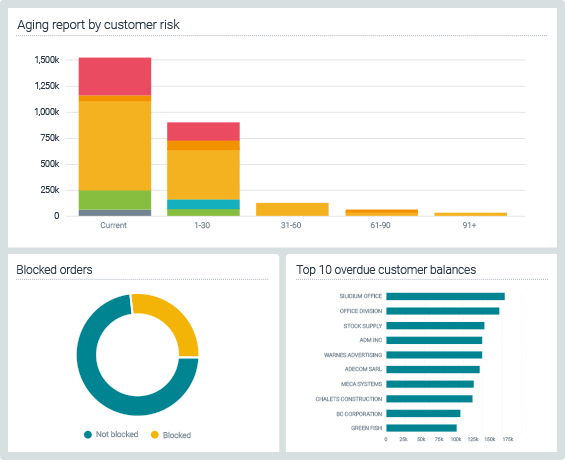

Elevate your decision making

with data-driven insights

In a constantly changing world, AR is no exception — AR leaders need accurate and relevant data to monitor performance, adjust strategies and goals, and make the best possible business decisions.

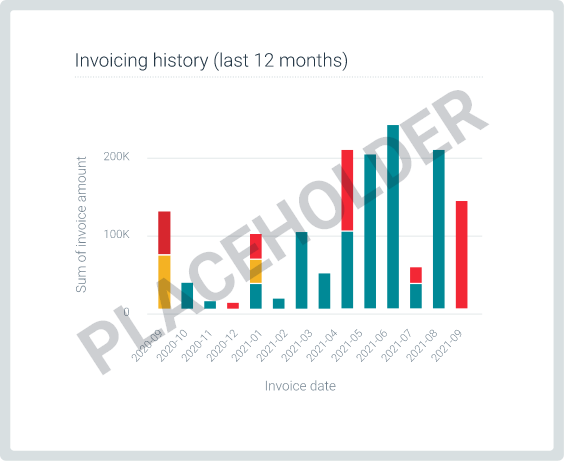

Esker’s AR solution suite is equipped with customizable dashboards and KPIs so you can keep an eye on key metrics (DSO, DDO, CEI, collections forecast, disputes, root-cause analysis, etc.) and adjust decisions accordingly. You can even build your own reports and share the “cash culture” throughout the organization.

Featured content

The Case for Accounts Receivable Automation: 3 reasons to transition to a digital future

Submitted by Caitlyn Riedl on Wed, 01/31/2024 - 10:04EnglishResource Type:Pinned to Top:NoExternal URL:https://quitpaper.esker.com/white-paper-the-case-for-accounts-receivable-automation-accounts-receivable-document-library.htmlBusiness Need:Preview Image: Take down date:Wednesday, July 1, 2026Culture Cash Episode:

Take down date:Wednesday, July 1, 2026Culture Cash Episode:- Log in to post comments

PYMNTs: Digital Payments for Improving Cash Flow & CX

Submitted by Rachelle Bowar on Tue, 07/02/2024 - 11:15EnglishResource Type:Pinned to Top:YesExternal URL:https://content.esker.com/report-digital-payments-AR-document-library.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

The Human Side of Accounts Receivable

Submitted by Caitlyn Riedl on Wed, 03/29/2023 - 09:55EnglishResource Type:Description:5 ways AR automation helps your team feel better, work smarter & stay longerPinned to Top:NoExternal URL:https://quitpaper.esker.com/guidebook-the-human-side-of-ar-accounts-receivable-document-library.htmlBusiness Need:Preview Image:

- Log in to post comments

See what our customers say on Gartner Peer Insights

Frequently asked questions

We’ve compiled answers to some of the most commonly asked questions about Esker’s Accounts Receivable automation solution. Have a question you can’t find the answer to? Reach out by clicking the “Get in Touch” button below.

Do I have to automate my entire AR process?

Only if you want it to! The beauty of our Accounts Receivable automation solution is in its flexibility. Our à la carte solution model allows users to choose if they automate one, some or all of the areas within their credit-to-cash process — from credit management and invoice delivery to collections, payment and even the cash application process.

What advantages will I see with an Accounts Receivable software solution?

Businesses using AR automation solutions should expect to see a more productive staff (thanks to fewer manual, admin-heavy tasks), optimized working capital (due to reduced costs, faster payments and secured revenue), enhanced visibility (via dashboards that provide detail metrics into AR performances, customer credit and more) and, last but not least, an improved customer experience that can ultimately lead to more business opportunities.

Does AR software integrate with all ERPs?

Yes! To date, Esker has over 70 unique ERP or home-grown solutions. Esker’s AR solution integrates with any ERP system or business application. Once the customer invoice is validated in the ERP, it’s quickly and securely transmitted to Esker to be processed. Customer information, payment status and open AR files can also be synchronized.

Our company is global — can an AR solution handle that?

Absolutely, it can. Automated Accounts Receivable software is designed for global organizations thanks to support of multi-languages, multi-sites, multi-currencies, worldwide payment coverage and global compliance. What’s more, the cloud-based nature of the solution enables different teams to collaborate more effectively while giving executives the visibility they need at every level of the organization.

Our partners

- Coming Soon