Cloud solutions for the banking industry

AI-driven tools to improve cashflow, decision-making & key business relationships

The win-win benefits of Esker solutions embedded in treasury services

Both customers and financial institutions can benefit from deeper technology integrations:

Integrate multiple billing/approval/payment processes into one, receive and send invoices electronically with access to a variety of payment options

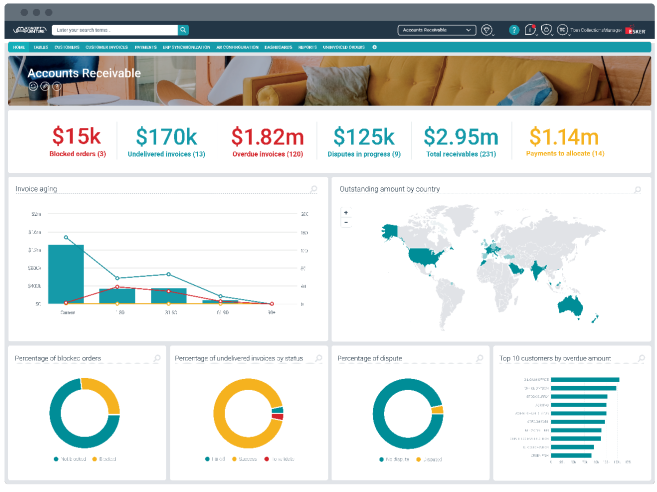

Gain actionable insights from payables and receivables dashboards to support treasury decisions, reduce DSO, optimize DPO, and improve cash forecasting.

Reduce time spent in preparing key business actions such as vendor payments,with pre-built payment runs and auto-payment of recurring, pre-approved expenses

Automate reconciliation from payments received and reduce DSO, with instant sync to cash positions and recent payment activity

Support the adoption of novel payment methods such as virtual cards through easy-to-use and value-added payment features

Optimize IT resources requirements with simpler implementations and pre-built,pre-tested connectors

Enhance the value of integrated receivables solutions to your customers

Improved accuracy and reduced errors: AI driven automation reduces the likelihood of manual errors in invoicing and payment processing.

Greater efficiency: Accurate invoices lead to quicker approvals and payments, consequently reducing DSO.

Real-time visibility: Intuitive dashboards provide real-time visibility into the status of invoices and payments. This transparency allows finance leadership teams to identify potential issues early, enabling quicker resolution and minimizing delays in cash collection.

Workflow collaboration: Automation streamlines the end-to-end AR process, eliminating bottlenecks and inefficiencies — ensuring invoices move swiftly through the approval and payment process.

reduction in processing time

of auto-allocation objective achieved by 6-month mark

decrease of unallocated cash at month-end

Driving growth through partnerships

Partners such as financial institutions can now achieve up to 43% overall efficiency improvement by augmenting their own suite of solutions through white-labeling or OEM’ing modern cloud platforms and specific process automation solutions like those offered by Esker. Financial institutions become one-stop-shop for cash infrastructure and cash optimization services.

Many company–partner relationships tend fizzle out as soon as the handshaking and contract-signing have wrapped up. Not with Esker. Our goal is to provide you with an abundance of marketing resources, sales tools and support so that you can bring Esker solutions to market as successfully and self-sufficiently as possible.

“Our strategic partnership with Esker will enable us to serve our customers better. Esker’s AI-driven platform complements our solution offerings and helps us deliver value-added services to businesses on their digital transformation journey.”

Our partners

- Coming Soon